If you are navigating the US real estate market in 2026, you have likely heard the terms “Home Loan” and “Mortgage” used interchangeably. You might hear a banker say, “We need to sign the mortgage,” and a moment later, “Your home loan is approved.”

Are they the same thing?

The short answer is: Technically, no. Colloquially, yes.

However, understanding the nuance between these two terms—and specifically the difference between a Primary Purchase Mortgage and a Home Equity Loan—can save you thousands of dollars in interest and legal fees.

This guide will break down the technical differences, compare the loan types you need to know about, and provide a 2026 market outlook to help you borrow smarter.

Part 1: The Definition Dilemma (Clearing the Confusion)

Before we dive into interest rates and credit scores, we must clear up the vocabulary. In the United States, the confusion stems from how we talk vs. how the law works.

1. The “Mortgage” (The Legal Instrument)

Strictly speaking, a mortgage is not a loan. It is a security instrument.1 It is a legal document you sign that gives the lender the right to take your property (foreclose) if you don’t repay the money you borrowed.2

- You don’t “get” a mortgage; you “give” a mortgage. You (the borrower) give the mortgage to the bank (the lender) as a pledge of security.3

2. The “Home Loan” (The Debt)

The home loan is the actual transfer of money. In legal terms, this is evidenced by the Promissory Note. The Note is your I.O.U. It outlines the interest rate, the repayment term (e.g., 30 years), and the monthly payment.4

The Bottom Line:

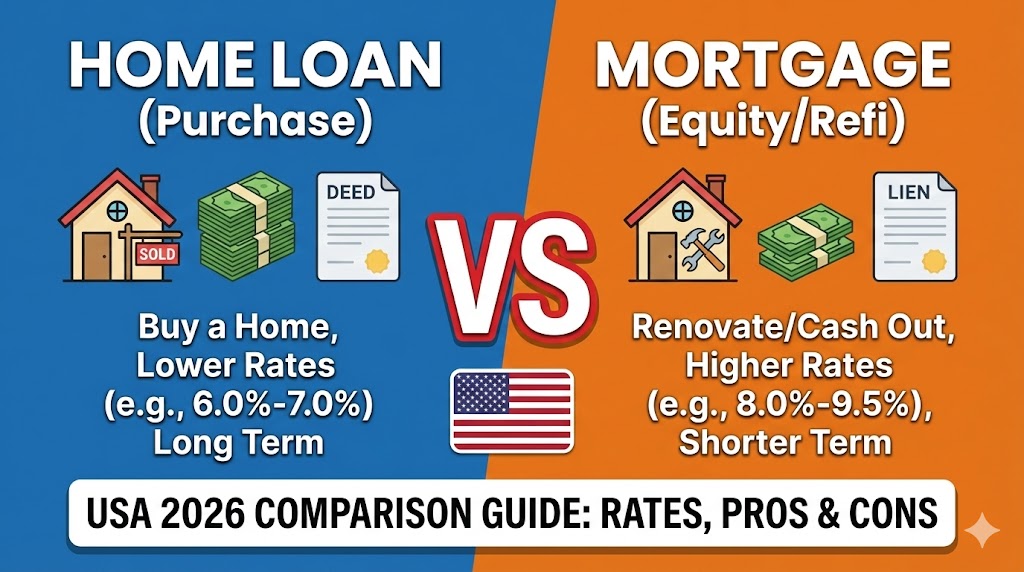

When most Americans say “I’m applying for a mortgage,” they actually mean they are applying for a Home Loan secured by a Mortgage. For the rest of this article, we will use the terms as they are most commonly compared in financial planning:

- Primary Mortgage: The loan used to buy the house.5

- Home Equity Loan (Secondary): A loan used to borrow against a house you already own.6

Part 2: Primary Mortgage vs. Home Equity Loan

This is the comparison that actually matters to your wallet. Most people searching for “Home Loan vs Mortgage” are trying to decide between buying a property (Purchase Mortgage) or tapping into their existing property’s value (Home Equity Loan).

Here is how they stack up in 2026.

1. The Primary Purchase Mortgage

This is the standard loan used to acquire a property.7 It is “First Position” lien, meaning if you go bankrupt, this lender gets paid first.8

- Best For: Buying a home.

- Interest Rates (2026): ~6.15% – 6.50% (Fixed).

- Tax Benefits: Interest is usually tax-deductible on the first $750,000 of debt.9

- Payment Structure: Amortized over 15 or 30 years.10

2. The Home Equity Loan (The “Second Mortgage”)11

This is a loan you take out after you have bought the house. You receive a lump sum of cash based on the equity you have built up.12

- Best For: Renovations, debt consolidation, tuition.13

- Interest Rates (2026): ~8.00% – 9.50% (Fixed).

- Tax Benefits: Interest is only deductible if the funds are used to “buy, build, or substantially improve” the home.14 If you use it to pay off credit cards, the interest is not deductible.

- Payment Structure: Fixed monthly payments, usually over 10 to 20 years.15

Part 3: Detailed Comparison Table

Here is a side-by-side look at the two major “Home Loan” types.

| Feature | Primary Mortgage (Purchase) | Home Equity Loan (Cash Out) |

| Primary Purpose | To buy a new property. | To get cash from a property you own. |

| Lien Position | 1st Lien (Priority). | 2nd Lien (Subordinate). |

| Typical Interest Rate (2026) | Lower (Approx. 6.2% – 6.5%). | Higher (Approx. 8.5% – 9.5%). |

| Loan Term | 15, 20, or 30 Years. | 5, 10, 15, or 20 Years. |

| Closing Costs | High (2% – 5% of loan amount). | Lower (Often 0% – 2%). |

| Disbursement | Money goes to the Seller. | Money goes to You (Lump Sum). |

| Approval Difficulty | High (Strict scrutiny of assets). | Medium (Focus on Equity + Credit). |

| Tax Deductibility | Yes (up to $750k debt limit). | Yes, only if used for home improvements. |

Part 4: Eligibility & Requirements in 2026

The criteria for getting approved have tightened slightly as banks navigate the post-inflation economy of the mid-2020s.

1. Credit Score (FICO)

- Primary Mortgage:

- Conventional Loan: Minimum 620. (Scores above 760 get the best rates).

- FHA Loan: Minimum 580 (with 3.5% down) or 500 (with 10% down).

- VA / USDA Loans: No hard minimum, but usually prefer 620+.

- Home Equity Loan:

- Lenders are stricter here. Most require a score of 680+ to qualify, and 720+ to get a decent interest rate. Because this is a “second” loan, the risk to the bank is higher.16

2. Down Payment vs. Equity

- Primary Mortgage (Down Payment): You need “skin in the game.”

- Standard: 20% (to avoid PMI).

- Minimum: 3% (Conventional) or 3.5% (FHA).

- Home Equity Loan (Equity): You don’t make a down payment; you need existing equity.

- The 80% Rule: Most lenders will not let your total debt (Primary Mortgage + Home Equity Loan) exceed 80% to 85% of your home’s value.

- Example: Your home is worth $400,000. You owe $200,000.

- 80% of Home Value = $320,000.

- Minus what you owe ($200,000).

- Available to Borrow = $120,000.

3. Debt-to-Income Ratio (DTI)

For both loan types, lenders in 2026 prefer a DTI ratio below 43%. This means your total monthly debt payments (including the new loan) should not exceed 43% of your gross monthly income.

Part 5: Interest Rates and The “Spread”

One of the most common questions is: Why are Home Equity Loan rates higher than Mortgage rates?

It comes down to risk.

The Scenario:

Imagine you have a Primary Mortgage with Bank A and a Home Equity Loan with Bank B. You lose your job and stop paying both.

- Bank A initiates foreclosure and sells your house for $300,000.

- Bank A gets paid back first because they hold the Primary Mortgage.17

- Bank B only gets paid if there is money left over.18

Because Bank B is in the “Second Position,” they are taking a bigger gamble. To compensate for that risk, they charge a higher interest rate (the “risk premium”).19

2026 Rate Projections:

- 30-Year Fixed Mortgage: Experts predict rates will stabilize around 6.0% – 6.5%.20

- Home Equity Loans: Expected to hover between 8.25% – 9.0%.

- HELOCs (Lines of Credit): These are variable rates and are currently higher, often 9% – 10% depending on the Prime Rate.

Part 6: Pros and Cons

Primary Mortgage

Pros:

- Lowest Interest Rates: The cheapest money you can borrow.

- Long Terms: Spreading payments over 30 years makes them affordable.

- Builds Wealth: You are paying for an appreciating asset.

Cons:

- Front-Loaded Interest: For the first 10 years, you are paying mostly interest, not principal.

- Closing Costs: Can be expensive ($5,000 – $10,000+).

- Inflexibility: It is hard to change the terms without refinancing (which costs money).

Home Equity Loan

Pros:

- Lump Sum Cash: Great for large, one-time expenses (e.g., a new roof or a wedding).21

- Fixed Rates: Unlike credit cards or HELOCs, your payment never changes.

- Lower Rates than Credit Cards: 9% is much better than the 24% APR on a Visa card.22

Cons:

- Risk of Foreclosure: If you can’t pay this loan, you can still lose your house, even if your primary mortgage is paid up.

- Closing Costs: While lower than a primary mortgage, they still exist.23

- Two Payments: You now have two housing bills to manage every month.

Part 7: The “HELOC” Alternative

We cannot talk about Home Loans without mentioning the HELOC (Home Equity Line of Credit).

While a Home Equity Loan is an installment loan (you get all the cash at once), a HELOC is like a credit card secured by your house.24

- Draw Period (Years 1-10): You can borrow money, pay it back, and borrow again.25 You usually pay interest only.26

- Repayment Period (Years 11-20): You can no longer borrow, and you must pay back principal + interest.

When to choose which?

- Choose a Home Loan (Equity) if you need $50,000 today for a contractor.

- Choose a HELOC if you want access to $50,000 over the next 3 years for ongoing projects.

Part 8: Frequently Asked Questions (FAQs)

Q: Can I have a mortgage and a home loan at the same time?

A: Yes. In fact, millions of Americans do. You have your main “Mortgage” (which you used to buy the house) and a “Home Equity Loan” (which you took out later for cash).27 This is often called “piggybacking.”

Q: Is a “Mortgage Note” the same as a Mortgage?

A: No. This is a common confusion.

- The Note is the promise to pay (the debt).28

- The Mortgage is the document that links that debt to your house (the collateral).29

- Think of it this way: The Note is the chain around your ankle; the Mortgage is the anchor the chain is attached to.

Q: Which one is easier to get approved for?

A: Generally, a Primary Mortgage is slightly easier if you have a lower credit score (thanks to FHA programs). Home Equity Loans are harder to get if your credit is bad because there are no government-backed Home Equity programs for bad credit.

Q: Can I pay off my mortgage with a home loan?

A: This is called Refinancing. You take out a new primary mortgage (usually with better terms) to pay off the old one. You technically don’t use a “Home Equity Loan” to pay off a mortgage; you replace one mortgage with another.

Q: Are closing costs different?

A: Yes. Primary Mortgage closing costs are usually 2-5% of the home price. Home Equity Loan closing costs are usually 1-2% of the loan amount, and some lenders even waive them (“No Closing Cost Loans”) in exchange for a slightly higher interest rate.

Conclusion: Which Option is Right for You?

In 2026, the choice between these financial products depends entirely on your goal.

- If you want to buy a house: You need a Primary Mortgage. Focus on improving your credit score to 760+ to lock in a rate near 6.0%.

- If you want to remodel your kitchen: You need a Home Equity Loan (or HELOC). This allows you to keep your low rate on your primary mortgage while accessing cash for improvements.

- If you are drowning in credit card debt: A Home Equity Loan can save you money.30 Swapping 25% credit card interest for 9% home loan interest is a smart mathematical move—if you stop using the credit cards.

Actionable Advice:

Before signing anything, ask your lender for the “Loan Estimate” (LE) form. This is a standardized government document that will clearly show you the APR, the closing costs, and the monthly payment. Compare the LE from three different lenders to ensure you are getting the best deal in the current market.